Medicare Eligibility: A Boon and a Trap

Let’s take a break from the ACA repeal-and-replace debate to look at an issue that frequently confuses (and trips up) unwary seniors entering Medicare: the impact of Medicare coverage on other insurance and how to approach enrollment in Medicare.

Basic Rules

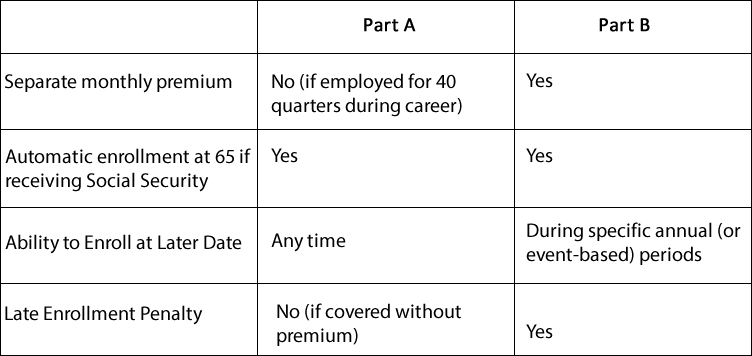

Eligibility for Medicare is really eligibility for two different types of insurance coverage: Medicare Part A (hospitalization) and Medicare Part B (physician services). Most Americans do not pay a monthly premium for Part A – it is paid for through payroll taxes during your career. And, enrollment in Medicare Part A is automatic if you are receiving Social Security benefits at least four months before your 65th birthday. As a result, enrolling in Medicare Part A at age 65 is easy.

Medicare Part B does have a separate monthly premium (currently $134/month, but the amount can vary based on your income or if you receive Social Security). Although the automatic enrollment rules for Medicare Part A also apply to Medicare Part B, you can decline enrollment in Part B if you do not want to pay the premium (for example, if you have other coverage).

Here is a chart summarizing the rules:

The Boon and the Trap

Eligibility for Medicare represents access to a range of health insurance coverages with a variety of federal subsidies and guarantees. Although it is not the end of all your health insurance worries, it does mean that you are protected from many of the worst-case scenarios (e.g., no insurance).

But, there are traps. Most notable is the trap of waiving Part B (and related coverages, such as Medicare Supplement coverage or prescription drug coverage under Medicare Part D) because you think you have coverage elsewhere. Here’s the rule to remember: you can safely continue to rely on your current coverage only if that coverage is from active employment (of you or your spouse) and your employer (or your spouse’s employer) has at least 20 employees. If you have any other coverage (such as retiree health coverage or coverage under COBRA) your pre-65 insurance coverage changes as soon as you enroll in Part A. At that point, your insurance company may assume that you are covered by Parts A and B and will pay you lower (or no) benefits. So, unless you have coverage based on active employment for an employer with at least 20 employees you should not assume your current coverage remains in place.

Unfortunately, health insurance is complicated and can be difficult to understand. The Medicare eligibility rules do not make it any easier, so you need to be careful.

Staying on top of rapidly changing developments

Multiple Personalities: The Administration’s Approach to the ACA

The Trump Administration and Republicans in Congress have been clear about their desire to “repeal and replace” the Affordable Care Act. But, while that legislative battle plays out, the ACA is still on the books and defines the rules for the American health care system. This blog post will not look at the repeal and […]

The Legacy of Obamacare

It is too soon to predict the fate of the American Health Care Act (AHCA), or, as we call it, TrumpRyanCare. But, the AHCA as currently proposed – and the debate among Republicans over its provisions – represents a significant statement. That statement: the core provisions of the ACA regarding insurance market reforms now appear […]

401(k) Plans and Health Savings Accounts: A Questionable Comparison

As the Administration and Congress define their vision of “repeal and replace” we are seeing a number of efforts to increase the use individual accounts as a key component of any likely Trump/RyanCare proposal. Health Savings Accounts (HSAs) figure prominently in a number of Republican proposals as a way for individuals to pay for current […]